What is a Special District?

State law defines a special district as “any agency of the State for local performance of governmental or proprietary functions within limited boundaries” (Government Code 1627[d]). Basically, a special district is a separate local governmental agency formed to provide local services.

Inadequate tax bases and competing demands for existing tax dollars make it hard for cities and counties to provide all of the services their citizens desire. When residents or landowners want new or higher levels of existing services, they form special districts to pay for them.

San Mateo County Mosquito and Vector Control District is an independent special district, which means it is a type of local government that delivers specific services to citizens within its boundaries under the guidance of its own Board of Trustees. The Board of Trustees for SMCMVCD consists of one voter from each city of the County's 20 cities, appointed by their respective City Council, to govern the Mosquito and Vector Control District knowledgeably and effectively. In addition, one voter is appointed by the San Mateo County Board of Supervisors to represent the County-at-Large. These 21 Board Trustees serve for a term of two or four years and are highly dedicated to this community service.

About two-thirds of the state’s special districts are independent districts. Examples of special districts are fire protection, police protection, water districts, harbor districts, school districts and open space. Districts, such as ours, are in existence today because taxpayers were willing to pay for public services they wanted and needed.

Advantages of Having a Special District

- Special districts can tailor services to citizen demand - Cities and counties must protect their residents’ health, safety, and welfare and thus, must provide many services, regardless of citizen demand. Special districts, however, only provide the services that the community desires.

- Special districts can link costs to benefits - General purpose local governments (cities and counties) levy general taxes to pay for public services. The services that taxpayers receive are not directly related to the amount of taxes they pay. In a special district, only those who benefit from district services pay for them.

- Special districts are responsive to their constituents - Because most special districts are geographically smaller and have fewer residents than counties and cities, they can be more responsive to their constituents. Small groups of citizens can be quite effective in influencing special districts’ decisions.

How Your Tax Amount is Figured

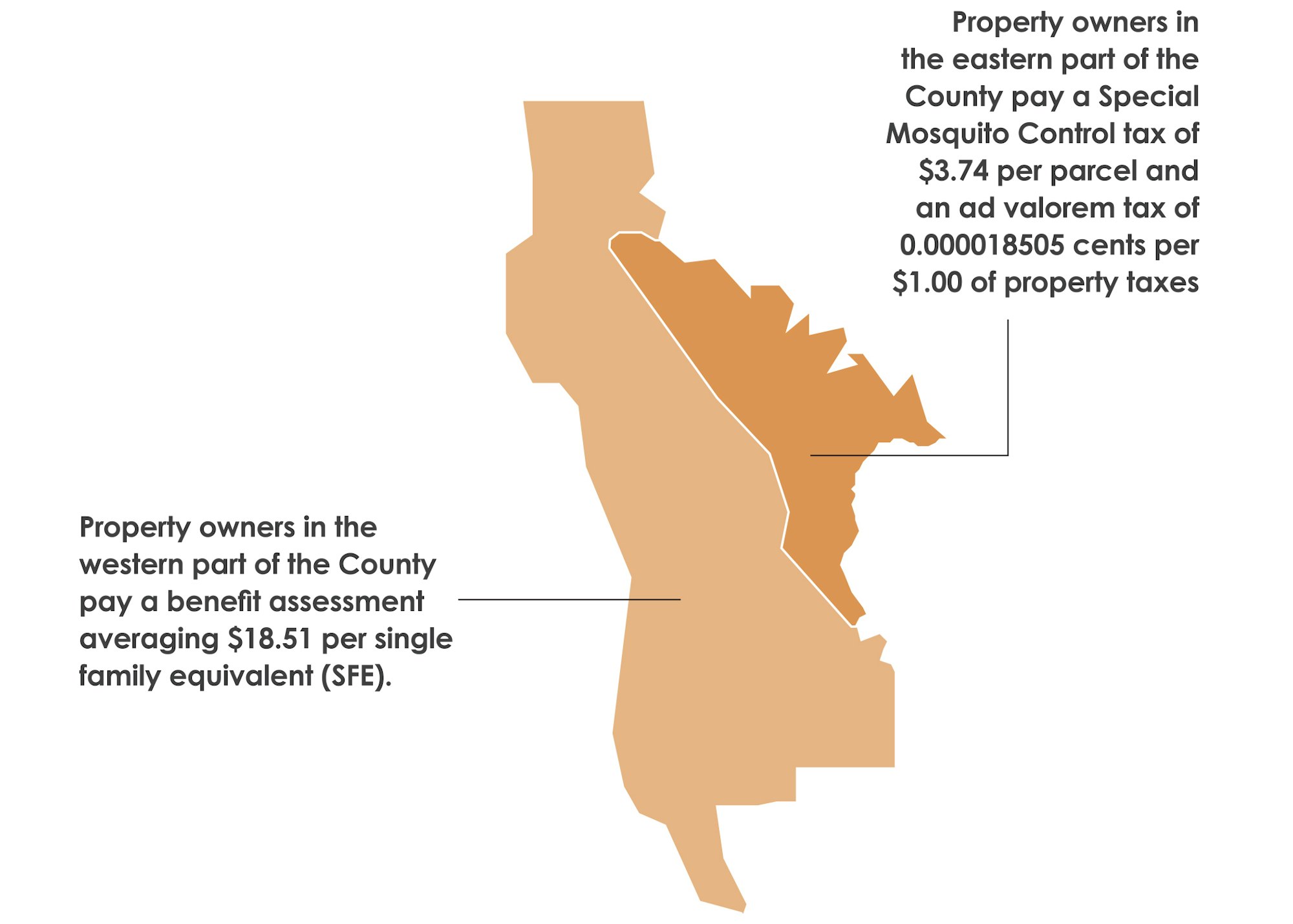

If you live in one of the 13 cities that made up our original service boundary (Atherton, Belmont, Burlingame, Foster City, Hillsborough, Menlo Park, Millbrae, Portola Valley, Redwood City, San Carlos, San Mateo, Woodside and San Mateo County at-large), a special election was passed in May 1982 by the voters in these cities allowing for a Special Mosquito Control Tax. The cost for this special tax is a maximum amount of $3.74 per parcel to be charged each tax year. Along with the $3.74 per parcel amount, 0.0000185505 of each property tax dollar for this area is delineated for use by Mosquito and Vector Control.

If you live in the more recently annexed areas of Brisbane, Colma, Daly City, Half Moon Bay, Pacifica, San Bruno, South San Francisco and any unincorporated coastal areas in San Mateo County, a benefit assessment was voted on and passed by voters in January 2004. The benefit assessment amount was established at $15.00 per SFE (single family equivalent) per tax year; the amount can be raised a small amount each year and has risen a few dollars over the years. Factors to determine costs for multi-benefit dwellings (agricultural, commercial or multi-resident properties) are adjusted by the factors of acreage and benefit received by the entire property. All benefit amounts in these cities are allowed an annual cost of living adjustment (COLA) based on the SF-Oakland-San Jose, All Urban Consumers Price Index rate published by the Bureau of Labor Statistics.

Page last reviewed: December 28, 2023